Comprehensive Retirement Planning

Ronald A. Bartlett & Associates, LTD.

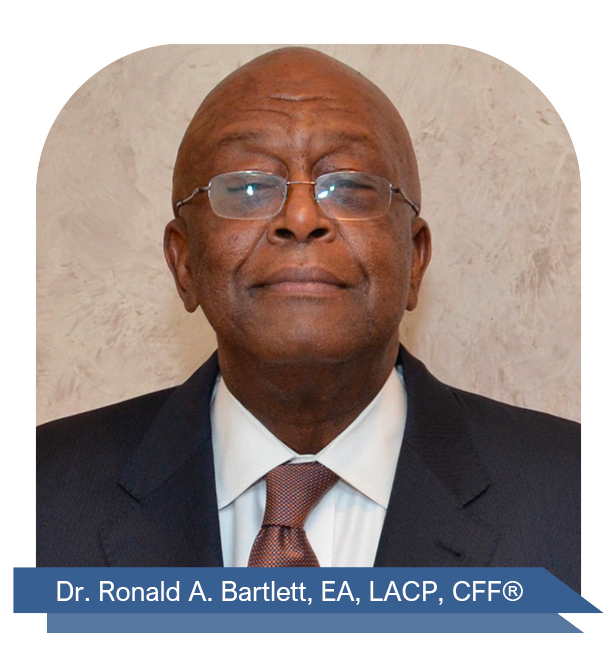

Ronald A. Bartlett & Associates, LTD. specializes in strategies and guidance for those who are seeking a better lifestyle in retirement. In November 2024, advisor Ronald A. Bartlett earned his Doctorate in Finance—a milestone that reflects his dedication to serving clients with the highest level of expertise. Since 2007, Ronald A. Bartlett & Associates has provided niche retirement solutions for the Telephone Communication Workers of America, demonstrating a strong commitment to union members and officers. Whether you have a retirement nest egg of $5 million or $50,000, we take the time to understand your individual retirement goals and ensure you have a plan that works for you.

Serving New York, New Jersey, Texas, and Florida, Ronald A. Bartlett & Associates, LTD. is dedicated to being available when you need them. There is no “best way” to retire, and each individual has unique requirements, different tolerances for risk, and need their money at different times. For exactly the same reasons, there is no one place to keep your money that suits everyone. Your unique circumstances must be taken into consideration in order to develop a retirement plan on your terms. This is where we can be of service.

Ronald A. Bartlett & Associates, LTD. is a Proud Licensed Representative Of:

It’s Time To Get On Track

Explore Our Services

Our mission is to serve individuals and couples in all areas of retirement planning. We provide customized financial strategies to help you achieve long-term goals and enjoy a more secure retirement. A reliable strategy can help keep your family’s future protected.

Retirement assets can be exposed to four major financial risks:

Market

Risk

Withdrawal

Rate Risk

Longevity

Risk

Medical and LTC Expenses

We can help you reduce these risks through a wide range of services and solutions, including:

Retirement Planning

No matter where you are in life, we can provide you the guidance, tools, and services to help prepare for retirement on your terms.

Investment Planning

Working with a financial professional can help you understand your complete financial picture and tolerance for risk — and provide a strategy to help you maximize all elements of your financial life.

Tax Planning & Resolution

Understanding how tax strategies are used to manage your tax bill should be a major part of any reliable financial approach.

Learn More About Tax Planning & Resolution

Estate Planning

Effective estate management enables you to manage your affairs during your lifetime and control the distribution of your wealth after death.

Learn How To Leave A Legacy For Your Loved Ones

401(k) Advice

Understanding the intricacies of your 401(k) plan is essential to maintain an optimal portfolio for your goals. Our team of experts can help guide you through this process.

Retirement Resources

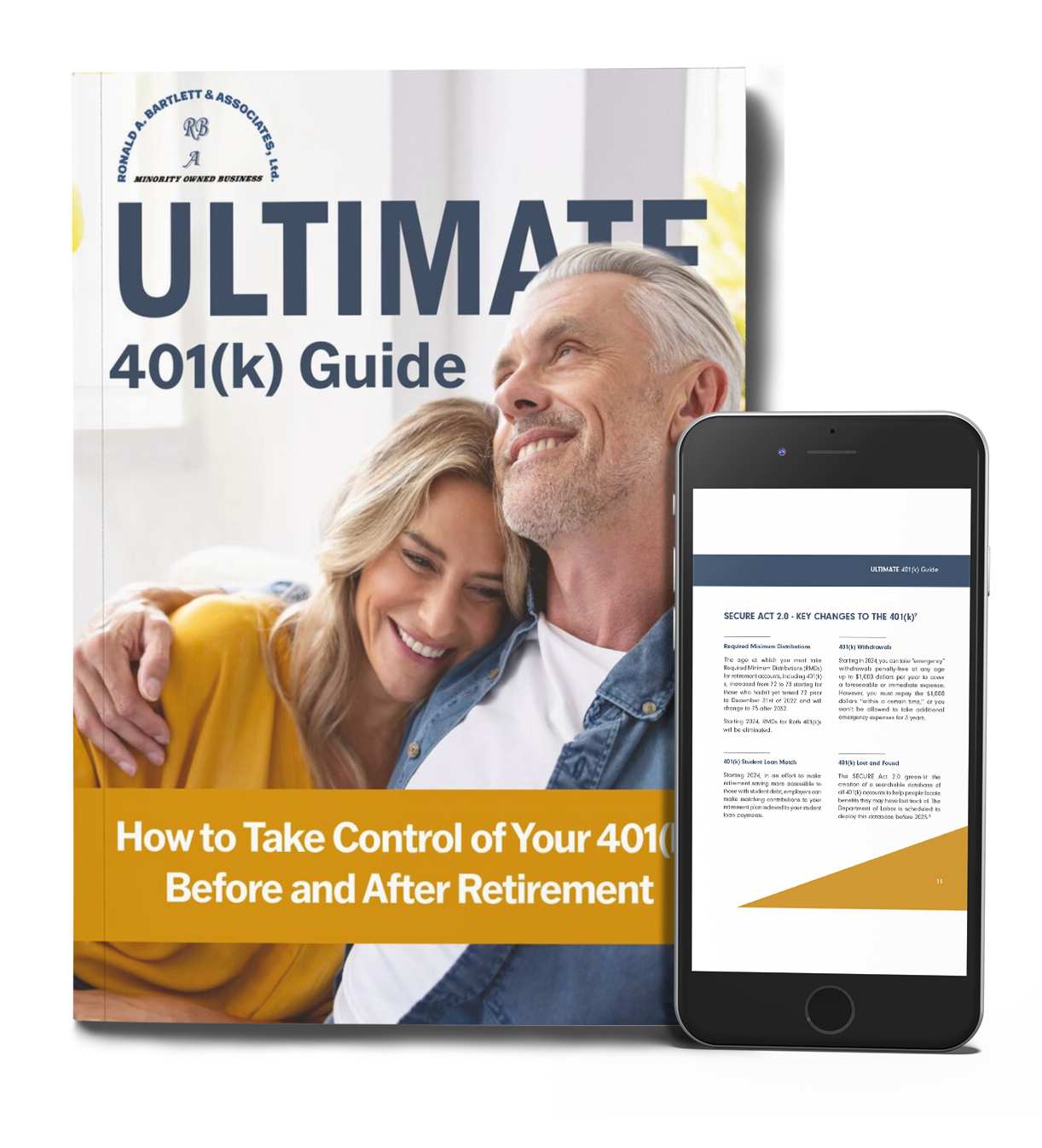

Download Our Complimentary Guide

The Ultimate 401(k) Guide

Take Control Of Your 401(k) Before And After Retirement

We all know that a 401(k) is one of the most important retirement planning tools we have. You pay into it for decades and will likely need to rely on it, among other income sources, for decades in retirement. The potential tax benefits and power of compound interest can make it a great saving and investment tool for anyone who practices financial discipline and contributes regularly.